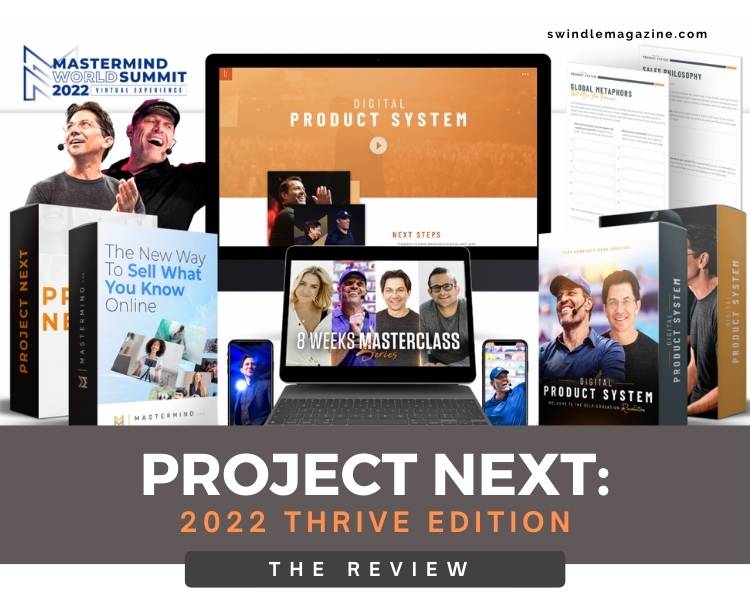

During these past few years, it felt as if our lives were on pause, and we couldn’t do anything about it. But come to think of it, business owners are successful because they can adapt quickly to changes and are highly innovative. But for these two, it seems

Continue reading